Your Banking, Our Cloud Recovery; We Partner, You Thrive!

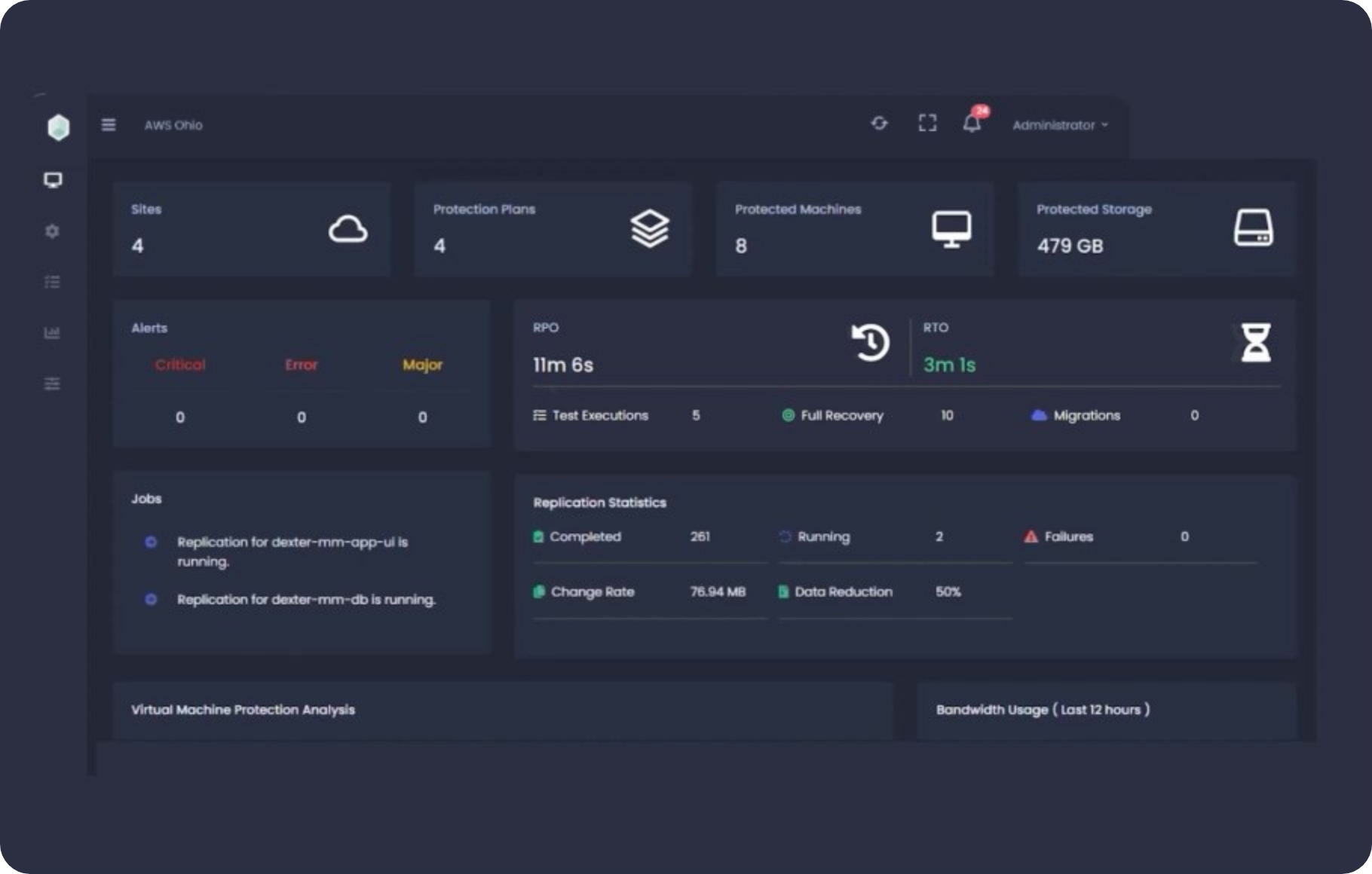

Migrate, recover, and consolidate your workloads with unmatched efficiency, compliance adherence, and a rapid 10-minute recovery time!

Revolutionize your banking operations with automated cloud disaster recovery, seamless data migration, compliance adherence, and a rapid 10-minute recovery time.