Compliance Excellence, Operational Efficiency: Insurance Security

Cut migration costs by 50%, TCO by 60%

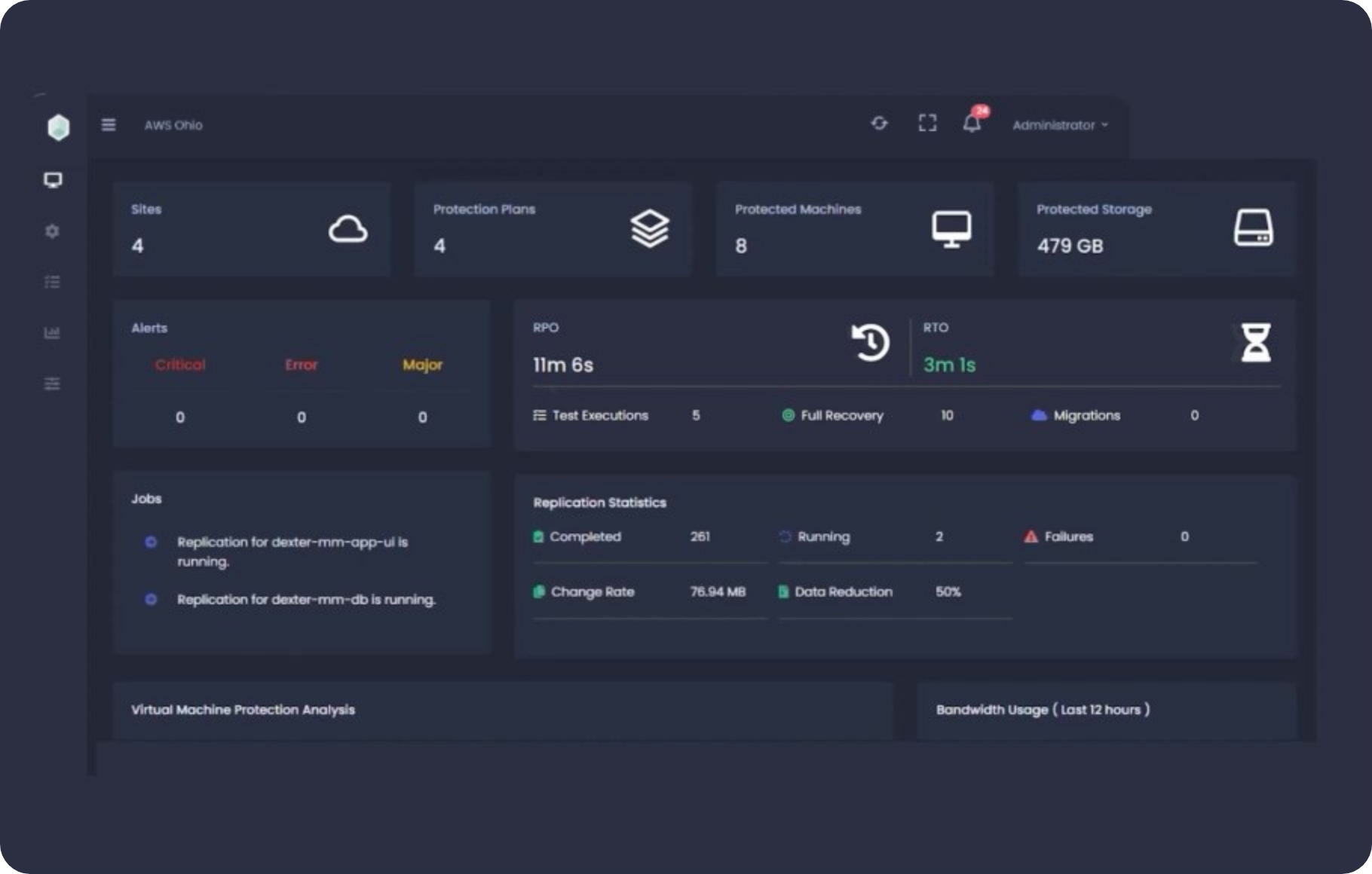

While you protect your customers from injury or loss, we make sure your data is protected with 100% data consistency, seamless migration, and centralized monitoring